|

|

|

|

|

|

|

|

|

|||

|

|

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

extended warranty comparison made practicalI want a plan that pays when things break, not one that sounds good on paper. That's why my extended warranty comparison starts with facts, not hype. What actually decides valueCoverage beats promises. I scan for specifics and ignore fluff. The clearer the document, the stronger the plan.

Common plan types compared

Cost versus risk, in plain numbersI sanity-check price against expected failure and replacement cost. Small math, big clarity.

A quick, real momentLast month I compared three laptop plans: the OEM wanted 17% with onsite next-day repair, the retailer offered 12% but mail-in only, and a third-party quoted 9% with a $99 deductible. Two weeks later the charging board failed. I chose the OEM plan; the tech arrived the next morning, and I was back working before lunch. The extra cost stung a little, but the downtime saved was worth it. Measured win. Red flags and green lights

How I read the fine print fast

Simple side-by-side lens

Practical tips that pay off

Checklist before you decide

Bottom lineI'm cautiously optimistic about extended coverage when the math clears and the service path is proven. Compare the details, price the risk, and pick the plan that protects time first and money second. Quiet confidence beats guesswork. https://www.noblequote.com/learning-center/comparison-and-types-of-warranties/manufacturers-vs-thirdparty-extended-car-warranties-a-comparison

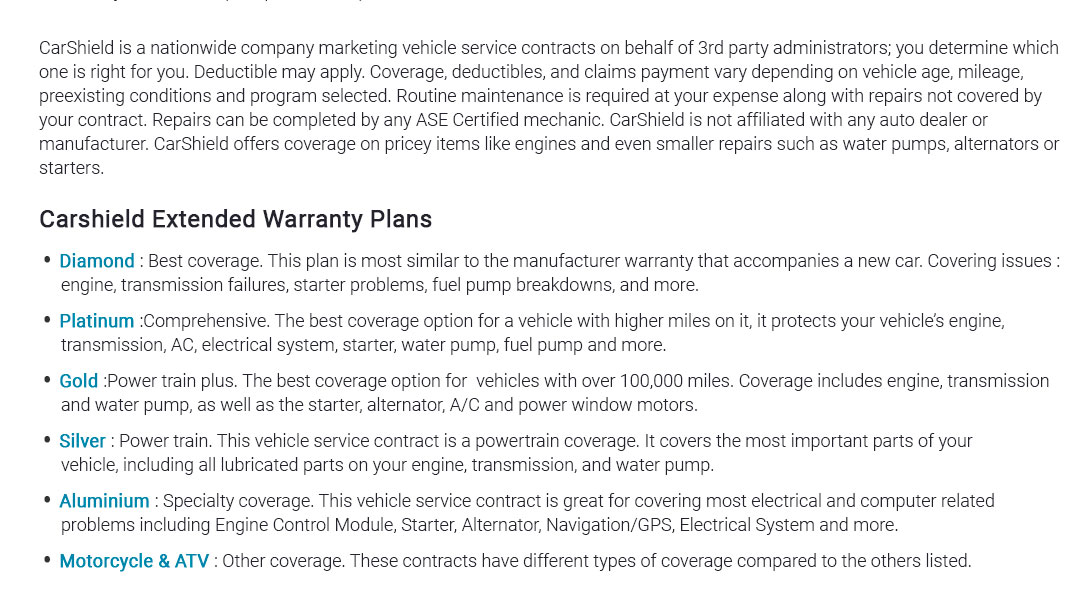

Third-party warranties can be more comprehensive, often including coverage for wear and tear, electronics, and more. Cost Comparison. https://www.caranddriver.com/research/a32766838/best-car-warranty-quick-comparison-guide/

Extended Warranty: Extended warranties function similarly to factory warranties, sometimes offering coverage beyond the factory warranty. They can also take the ... https://www.reddit.com/r/ToyotaGrandHighlander/comments/1e2mim8/extended_warranty_comparison_and_prices_what_did/

The dealership includes it all their new vehicles, costs about $2500, I negotiated it from $5k as I added other body and wheel protection.

|